A holistic HR solutions platform: financial education, earned wage access, payslips, savings, rewards, benefits and comms. Technical excellence, responsibly delivered.

Trusted by

More exciting new features to improve your financial and overall wellbeing coming in 2026!

Financial stress cripples productivity. It leads to mistakes, missed work and absconsion. Paymenow is the solution.

Paymenow offers your staff the tools to take back control of their money and perform at their best. Plus, you’ll also curb internal lending and make internal salary advances obsolete.

5 years of experience onboarding some of Africa’s largest employers across several countries

No business costs, ever. We can integrate with any payroll and disperse funds to any bank account

ISO-27001 certified and POPIA compliant

82% of users report lower debt levels and better credit scores

Our dedicated WhatsApp support line handles all app queries, any time

77% of users report an improved perception of employer

Our financial wellbeing solution takes users on a journey to better financial standing.

Allow your staff to meet pressing needs without debt

Give your people the skills and guidance to build financial stability

Enable long-term financial growth through saving and financial planning

As Africa's market-leading EWA provider, our expertise is built on a commitment to financial wellbeing. These numbers speak for themselves:

Years of Experience

Clients

Countries

Active Users

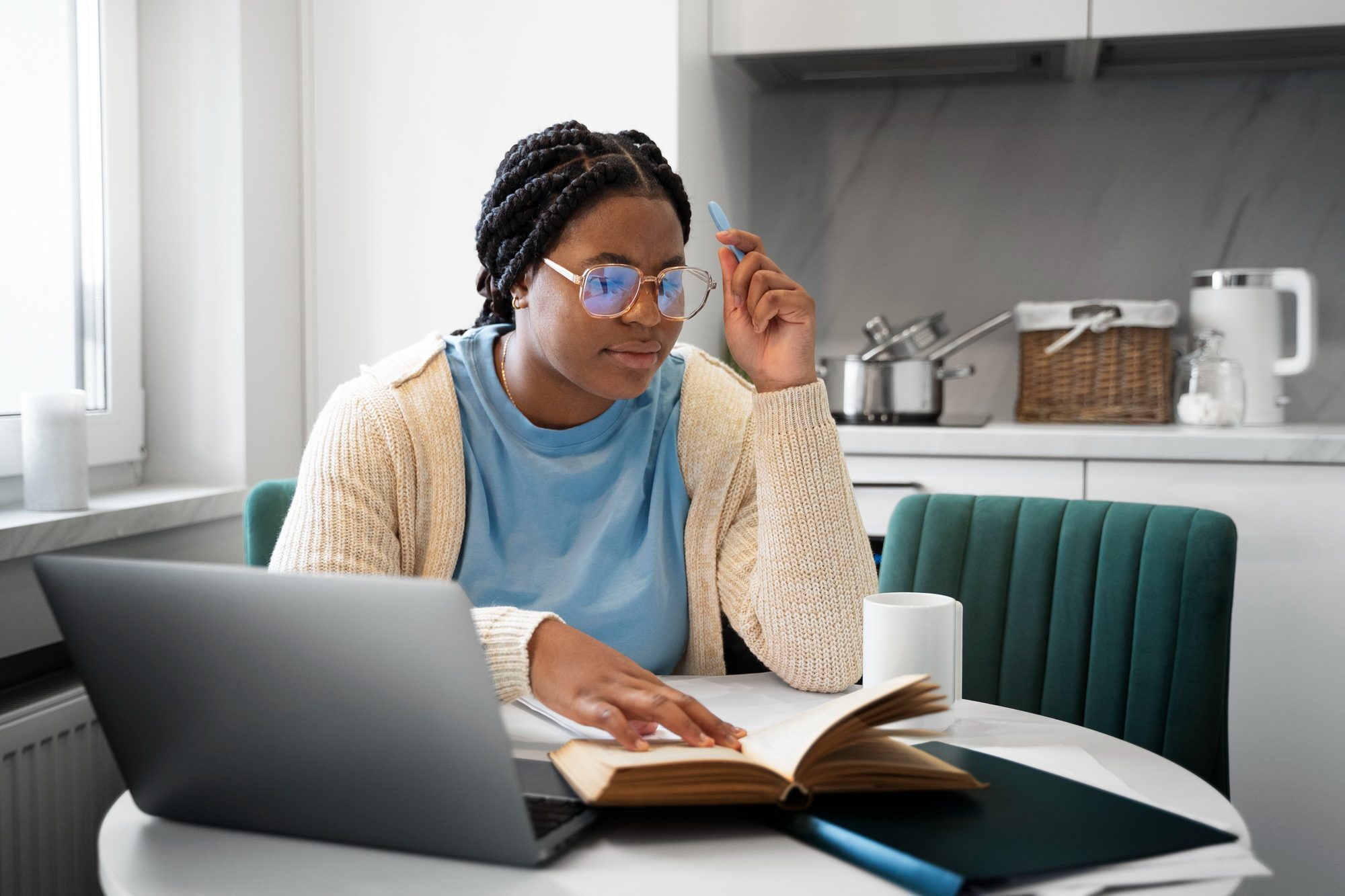

Our team of experts created a financial education journey based on the core principles of personal financial management, and adapted to the South African context.

In our latest impact report study conducted by independent impact measurement company 60 Decibels, Paymenow achieved a Net Promoter Score of 75 – nearly double the average benchmark!

“I no longer skip work due to a lack of transport money. I am always at work and on time.”

“Since I started using [Paymenow], I managed to pay all [of] my debts and get back to saving money”

“I no longer feel sick and stressed due to [finances]. It has also improved my relationship with my family.”

“Employees used to borrow each other money and end up fighting at work over it but now there a lot of peace”

Paymenow is your platform. You choose all access parameters, eligibility criteria and available products. Monitor usage via your dedicated employer portal and manage employees in real-time.

"Paymenow has truly been a lifesaver for our employees, providing them with a seamless solution to bridge the financial gap when needed. The quick, hassle-free process and exceptional service have made it a standout feature in our benefits package."

"Paymenow is a prime example for the rest of the South African

service industry on how to prioritise customer satisfaction."

"They are always professional and willing to go the extra mile

to ensure efficiency of the Paymenow service offering. The

team's standards are extremely high and it is a pleasure doing

business with you."