Earned Wage Access in Africa: The Rise of a Financial Inclusion Solution

Originating in North America during the 2010s, earned wage access (EWA), or on-demand pay, is a mainstream micro-finance option in the U.S. Powered by developments in payment technology, EWA enables employees to access to a portion of earned but unpaid wages to cover unexpected emergencies before their scheduled payday. And now this Western employee benefit is fast becoming a financial life-line for workers across Africa.

From Egypt to Nigeria to South Africa, Earned Wage Access (EWA) is gaining popularity in many African countries. The technology has been embraced by several African multination corporations, who partnered with EWA providers to make the service available to their staff. Just a few are Hungry Lion, Pepkor and Massmart Africa, all of which have a significant footprint in Africa. The EWA industry has also been able to grow because its vast potential has been recognised by several investors, seen by the number of tech start-ups receiving significant funding. For example, Nigerian-based EWA provider Pade disclosed receiving a $500,000 pre-seed raise, and one of their competitors received funding from the Bill & Melinda Gates Foundation. In South Africa, EWA company Paymenow received R250 million through RMB to expand access to their offering.

What Is Behind The Growth Of EWA In Africa?

A major driver of the demand for EWA is the prevalence of low wages across Africa. Workers earning lower wages are especially at risk of cash shortages before payday. If this happens, employees must either turn to high-interest payday loans to make it through the month, or ask for a salary advance (or both). There are also an abundance of unregistered lenders ready to offer loans with exorbitant interest rates.

These short-term solutions to financial troubles come at a steep price: high fees, exploitative interest rates and a high likelihood of becoming trapped in a debt spiral. For those in such situations, EWA becomes a lifeline. It is not only a far cheaper alternative to credit, but is also not actually credit – as EWA facilitates access to one’s own money, there is no debt accrued. This means workers are empowered to handle their financial difficulties with their own money.

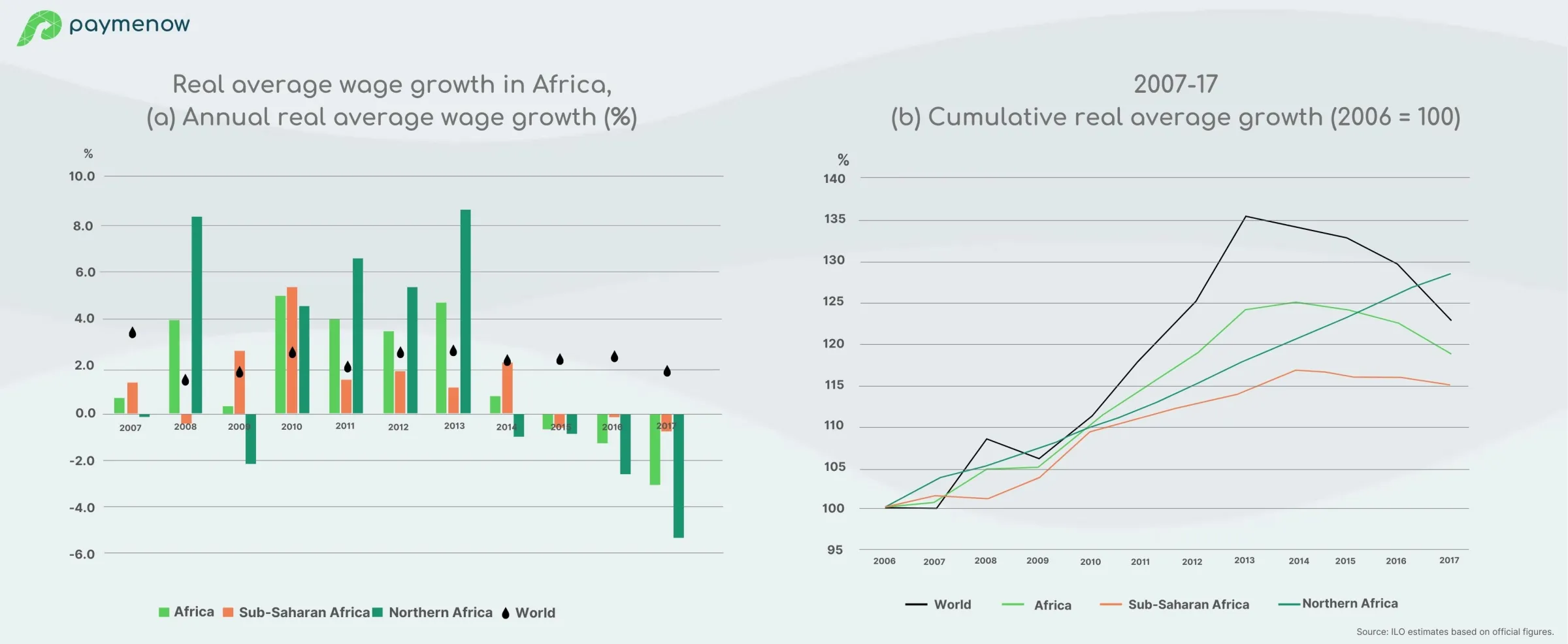

The popularity of EWA in Africa can also be explained by the low wages common across the continent. Following the African Development Bank, “almost 60% of Africa’s workers are in low-skilled jobs.” These low-skilled jobs typically pay low wages, and employees seldom have sufficient bargaining power to ask for increases. To make matters worse, wage growth in Africa is declining as compared to the rest of the world (according to a 2019 report from the International Labour Organisation). In combination with other factors such as high inflation, many workers across various African countries face an increased cost of living without the relief of a wage increase. It is these workers who are most at risk of cash shortages before payday.

For example, 2023 was likely one of the most financially difficult years South Africans have faced, according to Debt Busters. High inflation, high interest rates and crippling loadshedding have resulted in almost zero income growth and little disposable income. Consumers have 39% less purchasing power than in 2016. Debt Busters also found debt- to-income rations among their clients at highest-ever rates, with an average of 62% of consumers’ net income (take-home pay) going toward debt repayments. There is also a steady increase in consumers with payday loans (from 15% in Q1 2021 to 24% at Q4 2023). This indicates more consumers are struggling to make their money last the month.

These same workers are also the most financially excluded. According to estimates from African Business, almost 50% of Africans do not have bank accounts. This excludes almost half of Africans from accessing bank-provided credit, meaning bank loans cannot be used to cover emergencies. Other informal solutions only serve to worsen the problem: illegal loan sharks have been known to charge 50% – 100% interest on payday loans and use violence to collect the money. To these workers with very limited other options, earned wage access is a much cheaper and safer option to get cash quickly for dealing with an emergency.

What is next for the EWA industry?

The rise of EWA technology in Africa is addressing a major problem for low-income workers across the content, facilitating access to previously-unattainable liquidity. And as the EWA industry continues to expand in Africa, enabled by investor funding and partnerships with employers, EWA providers are looking to expand their services to offer even greater benefits. This includes access to additional financial wellness offerings like education, savings tools, and payroll services to further support underbanked workers. As earned wage access offerings expand and spread across Africa, this technology can bring financial inclusion and resilience for millions across the continent.