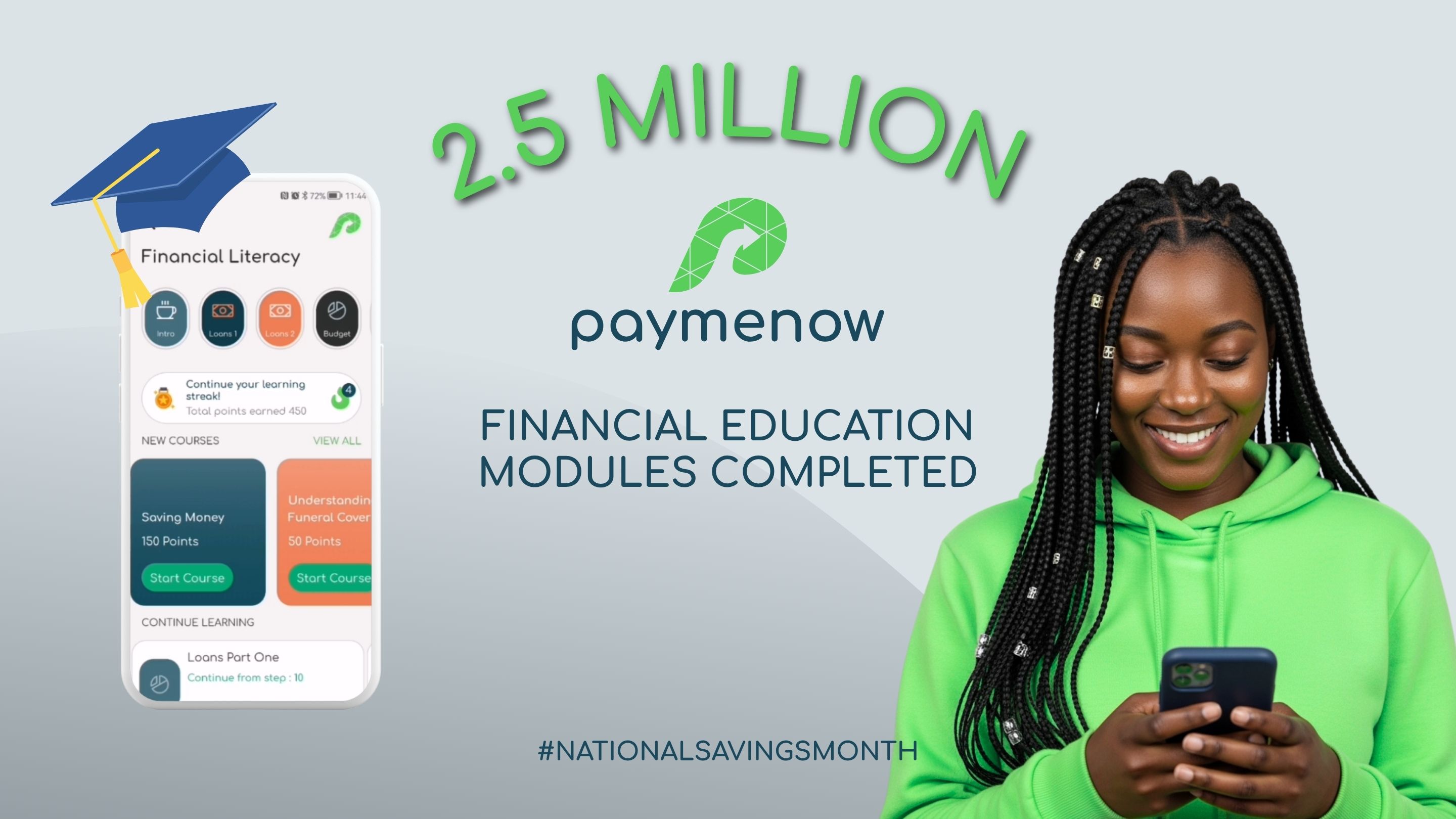

2.5 Million and Counting: South Africans Are Hungry for Financial Knowledge

And it's happening right as we celebrate National Savings Month

Picture this: It's a quiet evening after work, and instead of scrolling through social media, thousands of South Africans are learning about credit scores, budgeting, and savings strategies. They're not doing it because they have to – they're doing it because they want to take control of their financial futures.

This isn't just wishful thinking. It's happening right now, and the numbers are remarkable.

The Learning Revolution

Our Paymenow users have completed over 2.5 million financial education modules. Yes, you read that right – 2 500 000 million! As we celebrate National Savings Month this July, this data tells us something incredible about South Africans: when given the chance, they're eager to study their way to better financial health.

What South Africans Want to Learn About

Paymenow data on completed education modules shows where people are focusing their energy:

- Credit score education: Over 716,000 completions (clearly, we want to understand how this mysterious number affects our lives!)

- Basic financial wellness: Nearly 519,000 completions

- Savings options: More than 250,000 completions

- Budgeting: Over 250,000 completions

- Loan management: More than 250,000 completions

But it doesn't stop there. Over 76,000 users have tackled modules on the new two-pot retirement system, while more than 70,000 have learned about avoiding scams. This tells us something important: South Africans understand that financial literacy isn't just about balancing a chequebook – it's about navigating complex financial products and protecting themselves from risks.

The Knowledge Gap Challenge

But here's the thing – this hunger for knowledge comes at a time when South Africa faces a serious savings crisis. Our household savings rate sits at negative 1%. In other words, for every R100 of disposable income, the average South African family is spending R101. That extra R1 has to come from somewhere, and it’s usually debt. Moreover, national savings hover at just 15% of GDP (compared to the global average of 28%). This means millions of families are struggling to build financial security.

Why? Access to quality financial education remains limited for many South Africans. Studies consistently show that financial literacy rates are lowest among those who need it most – women, young adults, and those without a matric. This education gap perpetuates cycles of debt and prevents the development of a savings culture that could transform lives.

Why? Access to quality financial education remains limited for many South Africans. Studies consistently show that financial literacy rates are lowest among those who need it most – women, young adults, and those without a matric. This education gap perpetuates cycles of debt and prevents the development of a savings culture that could transform lives.

The Glimmer of Hope

If a lack of education is the cause, then it is also the solution. "When people understand how credit scores work, how to create budgets, and what savings options are available to them, they make fundamentally different financial decisions," explains Denise Neethling, our Head of Marketing. "The enthusiasm we're seeing for financial education shows that South Africans want to save and build wealth. They simply need access to the knowledge and tools to do so effectively."

The proof is in the pudding. Empowered with access to free education, four out of five Paymenow users report that their ability to save has improved since joining the platform. An impressive 92% say they would have had to borrow money without access to the service. What's particularly encouraging is that users who complete more financial education modules consistently make smarter financial choices. They're more likely to choose vouchers over cash withdrawals to benefit from lower fees, and they're building better long-term financial habits.

The Bigger Picture

"The completion of 2.5 million modules is both encouraging and sobering," Neethling reflects. "It shows us what's possible when financial education is made accessible and engaging. But it also highlights how much more needs to be done. If we're serious about building a savings culture in South Africa, we need to ensure that all citizens have access to financial education, not just those fortunate enough to work for employers who provide access to employee wellbeing platforms like Paymenow."

As National Savings Month draws attention to building financial reserves, the message from these statistics is crystal clear: South Africans are ready to learn their way to better financial health. The challenge now is ensuring everyone has the opportunity to access education that can transform not just individual financial futures, but the savings culture of our entire nation.